PitchBook Data, Inc: M&A Report 2017 Q3

Prices Continue To Rise Despite Slower Activity

M&A activity in North America totaled $925.3 billion across 7,348 transactions through 3Q 2017, 24.3% and 22.6% behind the first three quarters of 2016. The slowdown comes despite an increase in CEO confidence-a historical bellwether for M&A activity-and a 14.2% increase in the value of the S&P 500 (using total return) in the first three quarters of 2017.

Facing the possibility of major tax and healthcare reform this year, some investors in the US have taken a wait-and-see approach to M&A. If dealmakers get more clarity regarding potential changes to either system, they will be more likely to pursue deals.

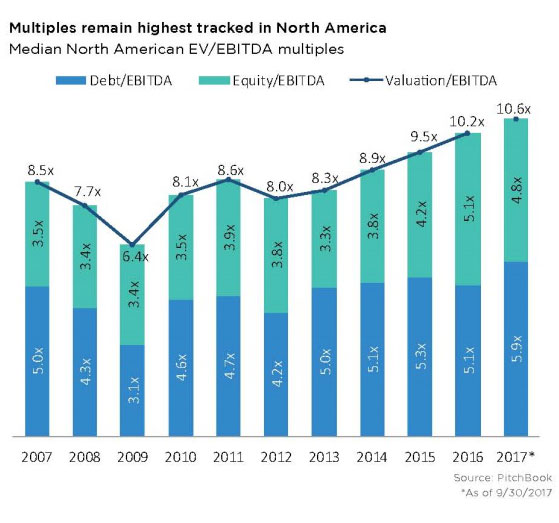

While activity slowed in North America, prices continued to rise. The median EV/EBITDA multiple for transactions completed through 3Q 2017 edged up to 10.6x-the highest we ve ever tracked. Easy credit continues to fuel price increases, with the median debt usage jumping to 5.9x EBITDA through 3Q 2017, comfortably higher than any other year in our dataset.

Higher debt multiples reflect the currently voracious appetite for leveraged loans, with new issuance volume on track to surpass pre-financial crisis levels, according to S&P LCD. Though equity contributions have inched downward to 4.8x EBITDA this year, they also remain elevated on a historical basis due to the elevated pricing environment.

For more information about M&A activity within a particular sector, please contact Gregg Schor at 631.285.3172, or GSchor@ProtegrityAdvisors.com.